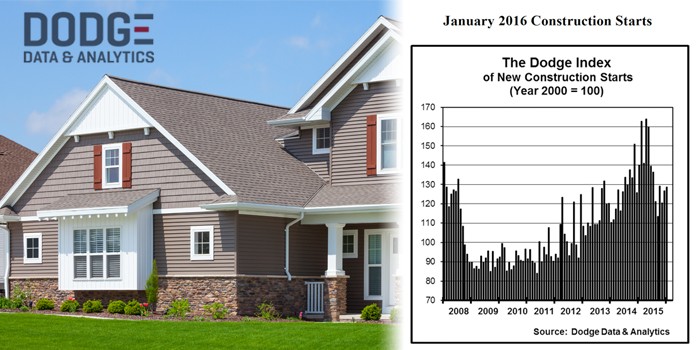

January Construction Starts Rise 2%

NEW YORK, NY – March 4, 2016 – The value of new construction starts in January grew 2% to a seasonally adjusted annual rate of $607.9 billion, according to Dodge Data & Analytics. The gain for total construction relative to December reflected moderate growth for housing. At the same time, nonresidential building retreated slightly in January, as increases for commercial building and manufacturing plant construction were offset by diminished activity for institutional building. The nonbuilding construction sector also retreated slightly in January, as modest improvement for public works was offset by a downturn for the electric utilities/gas plant category. On an unadjusted basis, total construction starts in January were reported at $40.6 billion, down 14% from the same month a year ago which featured the start of two massive liquefied natural gas (LNG) terminal projects in Texas. If these two LNG terminal projects are excluded, total construction starts in January would be up 1% from last year’s corresponding amount.

The January statistics raised the Dodge Index to 129 (2000=100), compared to a revised 127 for December. “The construction industry, as shown by the construction start statistics, seems to be gradually regaining upward momentum,” stated Robert A. Murray, chief economist for Dodge Data & Analytics. “Last year construction activity proceeded at a healthy clip during the first half, followed by a 20% drop in the third quarter, and then a slight 1% rebound in the fourth quarter. January’s modest gain for construction starts is consistent with what was shown at the end of last year. On the plus side, long-term interest rates remain low in early 2016, and such market fundamentals as occupancies and rents are supportive of further growth by multifamily housing and commercial building. The new five-year federal transportation act is in place and fiscal 2016 appropriations have been passed, which should help public works construction. On the negative side, the struggling global economy, the extended drop in energy prices, and the sliding stock market in early 2016 have raised the degree of uncertainty in the economic environment, which may contribute to a more restrained approach towards investment in the near term.”

Residential building in January advanced 5% to $294.0 billion (annual rate), helped by a 6% gain for single family housing. Murray noted, “January’s improved pace for single family housing may be the initial sign that it’s moving beyond the lengthy plateau that took hold during the second half of 2015. Admittedly, though, the winter readings on housing can be volatile and more monthly gains are needed before it’s possible to say that growth for single family housing is being re-established.” Multifamily housing in January increased 2%, showing further strengthening on top of the 22% jump that was reported in December. There were nine multifamily projects valued at $100 million or more that reached groundbreaking in January, with six of the nine located in the New York NY metropolitan area, led by two projects in Manhattan – the $256 million multifamily portion of a $265 million mixed-use high-rise and a $243 million apartment tower. Large multifamily projects above $100 million outside of the New York NY metropolitan area that reached groundbreaking in January were located in Chicago IL ($237 million), Seattle WA ($131 million), and San Francisco CA ($104 million).

RELATED Dodge Momentum Index Rebounds in December, Study Finds BIM Offers Substantial Benefits for Construction Industry, New Construction Starts Climb 13 Percent

Nonresidential building, at $180.3 billion (annual rate), slipped 1% in January. The institutional categories as a group fell 10%, pulling back from the improved volume reported in December. Healthcare facilities dropped 20%, as occasional gains such as the 11% hike reported in December for this project type continue to be followed by retreat. The largest healthcare facility projects reported as January starts were an $84 million hospital tower in Neptune NJ and a $65 million outpatient cancer center in Baltimore MD. The smaller institutional categories registered weaker activity in January – public buildings, down 5%; transportation terminals and religious buildings, each down 35%; and amusement-related work, down 49%. The amusement-related category in December had been boosted by such projects as the $478 million renovation and expansion of the Miami Beach Convention Center in Miami Beach FL and the $130 million renovation of the Nassau Coliseum in Uniondale NY. In January the largest amusement-related project was an $84 million addition to the Charleston Civic Center in Charleston WV. In contrast to the generally weaker activity reported for the institutional building group, the educational facilities category was able to climb 17% in January. The largest educational facilities project entered as a January start was a $108 million bioscience research laboratory at the University of Arizona in Tucson AZ. The latest month also included groundbreaking for three large high schools, located in Batavia OH ($99 million), Valdosta GA ($85 million), and Houston TX ($76 million).

The commercial building categories as a group grew 3% in January, following the 12% increase reported in December. Office construction led the way with a 29% gain, helped by groundbreaking for these projects – the $242 million Park Tower at Transbay in San Francisco CA, a $141 million office building in Boston MA, and a $91 million office building in Baltimore MD. Warehouse construction in January increased 17%, lifted by the start of a $134 million logistics center in Carlisle PA. Hotel construction in January grew 14%, with the upward push coming from the $205 million conversion of an office building to a hotel in the Times Square district of New York NY. Both stores and garages/service stations fell back in January after December gains, retreating 10% and 35% respectively. The manufacturing plant category in January jumped 59%, running counter to its generally declining activity witnessed throughout much of 2015. Large manufacturing plant projects that were entered as January starts included a $750 million methanol plant in Louisiana and a $125 million pipe manufacturing plant in Nebraska.

Nonbuilding construction in January dropped 2% to $133.7 billion (annual rate). The electric utility and gas plant category fell 18%, maintaining the broad downward trend that emerged during the second half of 2015 after a strong first half. Even with the decline, there were still several noteworthy power plant projects that reached the construction start stage in January, including a $900 million natural gas-fired power plant in Pennsylvania, a $303 million wind power facility in Michigan, and a $205 million solar power facility in Florida. The public works categories as a group edged up 1% in January, helped in particular by a 19% jump for highway and bridge construction. Large highway and bridge projects that were entered as January starts included the $655 million I-77 Toll Lanes project in the Charlotte NC area and a $100 million highway widening project in the Houston TX area. In addition, sewer and hazardous waste construction in January surged 68%, reflecting the start of a $300 million environmental dredging project in the Chicago IL area. The other public works categories experienced reduced activity relative to December, with water supply construction down 19%, river/harbor development down 30%, and miscellaneous public works (site work, mass transit, pipelines, etc.) down 32%.

The 14% decline for total construction starts on an unadjusted basis for January 2016 relative to January 2015 was the result of this performance by sector – residential building, up 13%; nonresidential building, down 5%; and nonbuilding construction, down 45%. By geography, total construction starts for January 2016 relative to January 2015 showed growth in three of the five major regions – the Northeast, up 36%; the South Atlantic, up 8%; and the Midwest, up 4%. Decreased activity was reported for the West, down 1%; and the South Central, down a substantial 53% given the comparison to January 2015 that included the start of the two massive LNG terminals in Texas.

Useful perspective is made possible by looking at twelve-month moving totals, in this case the twelve months ending January 2016 versus the twelve months ending January 2015, which lessens the volatility present in one-month comparisons. For the twelve months ending January 2016, total construction starts were up 6%, due to this pattern by sector – residential building, up 15%; nonresidential building, down 7%; and nonbuilding construction, up 11%. By geography, the twelve months ending January 2016 showed the following performance for total construction starts – the Northeast, up 19%; the South Atlantic and the Midwest, each up 5%; the South Central, up 3%; and the West, up 2%.

About Dodge Data & Analytics: Dodge Data & Analytics is the leading provider of data, analytics, news and intelligence serving the North American construction industry. The company’s information enables building product manufacturers, general contractors and subcontractors, architects and engineers to size markets, prioritize prospects, target and build relationships, strengthen market positions, and optimize sales strategies. The company’s brands include Dodge, Dodge MarketShare™, Dodge BuildShare®, Dodge SpecShare®, and Sweets. To learn more, visit www.construction.com.